Contents

Key Features

The Capital One Walmart Rewards Card is the ideal card for Walmart shoppers.

Let’s look at why…

The key features of a Capital One Walmart Rewards Card include:

- 5% cashback on all Walmart.com purchases, including grocery delivery and pickup

- Zero annual fee

- 2% cashback on all Walmart in-store purchases

- 2% cashback on restaurants and travel expenses

- 1% cashback everywhere Mastercard is accepted

Plus, as an introductory offer to new applicants, you can earn an additional 5% cash back on all Walmart store purchases for your first year when you pay with your Walmart Rewards Card through Walmart Pay.

As mentioned above, your Capital One Walmart Rewards Card can be used anywhere Mastercard is accepted.

Rewards Earning & Redemption

The rewards you earn through your Capital One Walmart Rewards Card come in the form of cashback rather than “points.” With cashback, you can put these earnings toward paying off the balance of your card, use them to purchase gift cards, or redeem them for travel costs. You can also redeem your cashback rewards in the form of a check if you choose.

You can track your cashback rewards through your Capital One account online or through the Capital One mobile app.

Annual Percentage Rate

An annual percentage rate (APR) is the total amount you can expect to pay each year in interest and fees on your credit card. The Capital One Rewards card advertises a 17.99% or 28.99% APR. Depending on your credit score, you will either be granted a lower or higher interest rate.

All Capital One interest rates are variable, meaning that your interest rate may fluctuate based on market conditions.

Remember that APR only applies to your outstanding balance. If you pay off your credit card each month, you can theoretically earn all of the rewards without having to pay a cent in interest.

Fees

One of the best parts of the Capital One Rewards Card is that it comes with zero fees.

For example, there is no signup fee or annual fee, and you’ll only pay interest on your outstanding balance.

How To Apply

To apply for a Capital One Walmart Rewards card, start by clicking here.

Next, you can decide to either get pre-approved or start your application right away.

The benefit of pre-approval is that you can find out whether you’re likely to qualify for the card without your credit score being affected. Anytime you apply for a credit card, a hard credit check is pulled on your credit history, and this can lower your credit score temporarily. Seeking pre-approval first helps to ensure that the hit to your credit score is worth it.

To seek pre-approval, click “See if I’m Pre-Approved.” Otherwise, click “Apply Now.”

During the application process, you will be asked to provide the following…

- Legal name

- Birthdate

- SSN

- Citizenship status

- Residential address

- Email address

- Phone number

- Employment status

- Annual income

- Monthly rent or mortgage

- Bank account information

If you are not approved for the Capital One Walmart Rewards Mastercard, you will automatically be offered the Walmart Rewards Card, which is an alternative card that can only be used at Walmart. Despite having its limitations, the Walmart Rewards Card can still earn you 5% cashback on Walmart.com purchases as well as a few other small perks.

In most cases, you will find out immediately upon submitting your application whether or not you have been approved. However, in some cases, you may have to wait a bit longer.

To check the status of your Capital One credit card application, call 800-903-9177.

Is It Hard to Get This Card?

Most applicants must have a credit score of at least 640 to get approved for a Capital One Rewards Mastercard. However, if your credit score is lower than this, you will still have the option of accepting the Walmart Rewards Card, which can only be used at Walmart.

If your credit score is fair or poor, you most likely will not be approved for a Capital One credit card. However, Capital One has been known to make exceptions for those with complex circumstances.

Shopping

Shopping with your Capital One Rewards Card is as easy as shopping with any other Mastercard.

Simply shop online or visit any retailer or business that accepts Mastercard, and shop away! It’s as simple as that.

As one of the largest credit card companies in the world, Mastercard is accepted everywhere that accepts credit cards.

Pros & Cons

The Capital One Walmart Rewards Mastercard can definitely be a great option for those who shop on Walmart.com frequently. However, there are some pros and cons that should be considered before applying.

The pros include…

- High rewards when shopping on Walmart.com

- Cashback on every purchase

- No annual fee

- Reasonable APR for those with existing good credit

The cons include…

- Low rewards for purchases not made on Walmart.com

- High interest rates, especially for those with less impressive credit upon approval

- 5% cashback does not apply to purchases made in person at Walmart

Customer Reviews

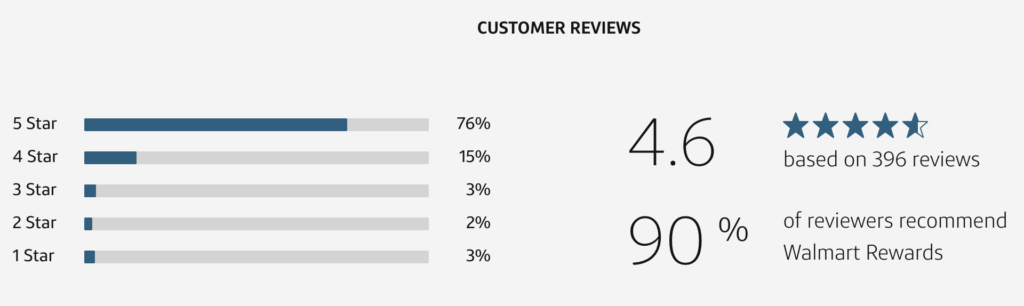

Overall, the Capital One Walmart Rewards Card has a great reputation among customers, with 90% of users recommending the card.

However, there are some important limitations to be aware of that impact the way customers see and use this card.

This reviewer offers some valuable feedback about the pros and cons of the Capital One Walmart Card…

This customer has great things to say about Capital One, including that he was approved for the card despite having bad credit…

FAQs

FAQs

Does Walmart automatically increase your credit limit over time?

In some cases, yes. With a Capital One Rewards card, you can qualify for a credit limit increase in as few as six months if you make all of your payments on time. The longer you remain a reliable customer, the higher your credit limit can go. However, not everyone will receive extensions on their credit limits.

What is the highest credit limit for a Walmart credit card?

There is no official maximum credit limit for a Capital One Rewards Card. However, the highest starting credit limit reported for a Capital One Rewards card is about $5,000.

Can you withdraw money from your Capital One Walmart card?

Sort of. While the Capital One Walmart Rewards Card does not work like a debit card (meaning that you cannot withdraw money from it at an ATM), you can redeem your cashback rewards in the form of a check.

FAQs

FAQs