As the largest retail corporation in the world, Walmart employs well over two million people worldwide. Pretty impressive, right? It’s no wonder that with so many employees, Walmart has made a point to provide its workers with a wide range of benefits. Similar to an employee stock purchase plan, Walmart offers something called an associate stock purchase plan to all of its employees.

A traditional employee stock purchase plan–commonly referred to as an ESPP–allows the employees of a publicly traded company to purchase shares of that company at a discounted price.

However, the Walmart Associate Stock Purchase Plan works a little differently.

Walmart’s ASPP is a matching program which offers a 15% match on all stock purchases made through payroll deductions up to $1,800 each year. In other words, if a Walmart employee opts to have $10 deducted from every paycheck to purchase Walmart stocks, Walmart will add an additional $1.50 onto that contribution each pay period.

Here is the basic breakdown of Walmart’s Associate Stock Purchase Plan according to the Walmart Associate Benefits Book:

“The Associate Stock Purchase Plan (ASPP or Plan) allows you to buy Walmart stock conveniently through payroll deductions and through direct payments to the Plan Administrator. You can have any amount from $2 to $1,000 withheld from your biweekly paycheck ($1 to $500 if you are paid weekly) to buy stock. Walmart matches $0.15 for every dollar that you contribute through payroll deduction to purchase stock, up to the first $1,800 you contribute to the Plan in each Plan year (April through March).”

For an in-depth look at Walmart’s ASPP, you can find their 2022 Associate Benefits Book here and scroll to page 268.

Contents

How Does ASPP Work?

The first thing to know about Walmart’s ASPP is that it is operated by a third-party company called Computershare. The money deducted from your Walmart paycheck each pay period is routed into an Computershare account and designated for the purchase of Walmart shares.

Any Walmart associate can volunteer to have a specific amount (between $2 and $1000) deducted from each of their biweekly paychecks to be used to purchase Walmart stocks.

This money is sent to your Computershare account. Once the balance in your account reaches the amount necessary to purchase one share of Walmart stock, you will automatically become the owner of a share. The more money you accumulate in your Computershare account through payroll deductions, the more Walmart stock you will own.

And most importantly, for every dollar you contribute through payroll deductions to the purchase of Walmart stock, Walmart will match $0.15 of that dollar. In other words, Walmart will increase your overall contribution by 15% at no charge to you. They will match your contributions up to the first $1,800 you donate in a single stock year.

According to Walmart, the following is a list of some important things to know about your ASPP:

- All eligible associates can purchase Walmart stock through convenient payroll deductions and direct payments to Computershare.

- There are no fees to purchase shares of Walmart stock through your ASPP. You only pay a fee when you sell shares of stock.

- Your shares will be credited to an account that is maintained in your name at Computershare. You can access your account online, by telephone, or through the Associate Stock app to get your balance or sell stock held in your account.

- Computershare’s direct stock purchase plan is not sponsored by Walmart.

If you need assistance with your purchase plan, you will need to contact Computershare directly at 1-800-438-6278 or by visiting www.computershare.com/walmart.

If you are a Walmart employee, current or former, with any questions about your Walmart shares, you should contact the Walmart Participant Service Center at 1-888-968-4015. The system is automated, but representatives are available on weekdays from 9AM to 7PM EST.

To read the extensive corporate bylaws for the Walmart ASPP, click here.

Do Walmart Employees Get Discounts On Stock Purchases?

The question of discounts on Walmart stocks for associates is a bit complicated. The short answer is that Walmart associates do not receive discounted rates when purchasing Walmart stocks.

However, when a Walmart associate purchases Walmart stock through payroll deductions, Walmart will match $0.15 for every $1 invested, up to the first $1,800 contributed each year. This means that if you contribute $1,800 to a stock investment plan through payroll deductions, an additional $270 will be invested on your behalf by your employer.

Does Walmart Match Employee Stock Purchases?

Instead of offering straight forward discounts on stock prices, Walmart offers a stock purchase matching program.

For every $1 a Walmart associate invests in Walmart stock through payroll deductions, Walmart will match $0.15 of that investment. Associates are eligible for dollar-by-dollar matching up to the first $1,800 they invest each year.

If you purchase Walmart stocks through Computershare directly without using the payroll deductions feature attached to the ASPP, you will not be eligible for matching.

Walmart associate investments in Walmart stocks cannot exceed $125,000 in a single plan year.

How Do Walmart Employees Purchase Stocks?

To purchase Walmart stocks as a Walmart employee, follow these steps:

- First, enroll in the ASPP by completing an online benefits enrollment session on One.Walmart.com/ASPP.

- Next, you will need to opt in to payroll deductions by speaking to your manager or supervisor and letting them know how much money you would like to have deducted from each paycheck. You can have anywhere from $2 to $1,000 deducted from your bi-weekly paycheck. If you opt to have $70 deducted, this will guarantee you’ll get access to the maximum amount of contribution from Walmart ($270 for the year).

- Once your payroll deductions are set up, your money will be invested automatically through Computershare.

- If you ever need to manage any aspect of your Computershare account, check on your stocks, etc. visit www.computershare.com/walmart.

What Happens To Walmart Stocks When You Quit?

The Walmart Associate Benefits Book has the following to say in regards to this important question:

“If you leave the company, you will have several options concerning the status of your account:

- You can keep your account open without the weekly or biweekly payroll deduction and the company match. You can make voluntary cash purchases and benefit from having no broker’s fee. There is an annual maintenance fee of $35 per year, which will be automatically deducted from your account through the sale of an appropriate number of shares or portion of a share of stock to cover the fee during the first quarter of the year.

- You can close your account and transfer your shares to another brokerage.

- You can close your account and sell some or all of the shares in your account.

In order to prevent any residual balances and to avoid paying a sales transaction fee twice, wait until you receive your final paycheck before closing your account. It is very important that you update Computershare if you have an address change after you have left the company.”

What Happens When You Sell Walmart Stocks?

If you choose to sell some or all of your Walmart stocks, be aware that you will have to pay some fees.

According to Walmart, “the fee is $25.50 per sale plus $0.05 per share sold for each sale you execute.” Walmart also states that this fee is subject to change at any time.

You can sell your stocks from computershare.com/walmart, from the Associate Stock app, or by calling Computershare directly at 800-438-6278. The money you receive through the sale of your stock can be deposited into a bank account on file or sent to you via check.

If you choose to have your money deposited, you should expect to see it in your account within 2 days. If you have your money sent to you in the mail, you can expect to receive your check within 7-10 business days.

Walmart’s Associate Stock Purchase Plan Reviews

Whether or not to take advantage of the Walmart Associate Stock Purchase Plan is a personal decision. However, most Walmart associates seem to think it’s a good idea.

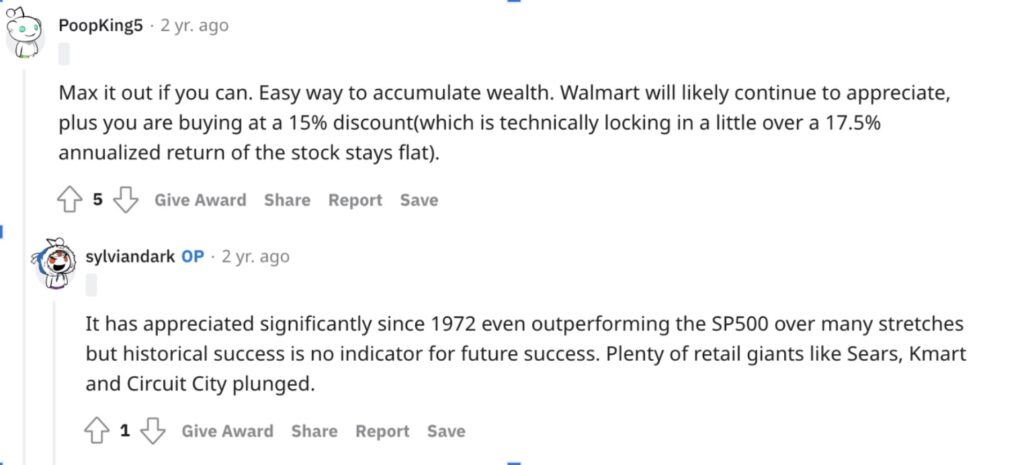

Most of the contributors on this Reddit thread say it’s a no-brainer to take full advantage of the Walmart Associate Stock Purchase Plan every year.

The only downsides to the ASPP are:

- Depending on how much you work, you might have to contribute a fairly large portion of your paycheck each pay period in order to take advantage of Walmart’s contributions.

- Walmart stocks aren’t guaranteed to continue growing (and they’ve decreased in value over the course of 2022).

FAQs

How can Walmart employees access their stocks?

Through your Computer share account. According to Walmart, “your shares will be credited to an account that is maintained in your name at Computershare. You can access your account online, by telephone, or by app to get your balance or sell stock held in your account.”

What is the highest stock price for Walmart?

$158.60. Walmart’s shares reached their all-time high on April 21, 2022. However, the price per share has since dropped by about $10.

Is Walmart a good long-term investment?

This is unclear. While it could be argued that in the long term, Walmart is likely to remain a large and profitable global corporation, many investors argue that now is not the best time to invest in Walmart stock. According to Investors.com, “Walmart stock is not a good buy right now.”

Conclusion

The Walmart Associate Stock Purchase Plan is a great way to get a bit more bang for your buck when investing in Walmart stock as a Walmart employee. For every dollar invested through payroll deductions, Walmart will contribute an additional $0.15 to your stock purchase account with their partner company Computershare. Walmart will match your contributions up to the first $1,800 you contribute in a single plan year. This means that you could get $270 invested for free (to you) on your behalf by Walmart each year. As of 2022, that’s the price of almost two shares of Walmart stock.