First introduced at Walmart in 2019, Affirm offers a seamless way for shoppers to finance their purchases without using a credit card or layaway program.

Customers can check their eligibility online before shopping using a desktop or mobile device. Similar to a traditional credit card, not all shoppers will qualify for an Affirm account. However, being approved for Affirm does not affect your credit score, unlike opening a new credit card.

Affirm financing differs from layaway in the sense that shoppers can immediately take their purchases home rather than having to wait until their payments are complete. Unlike with a traditional credit card, Affirm users never have to pay late fees on their payments. In some cases, however, customers who use monthly payment options will pay some interest on their purchases.

It’s important to understand that even after you have an Affirm account, you still have to apply for a loan each time you want to make a purchase. Keep reading to learn more about how to do this at Walmart.

Contents

Requirements

To qualify for Affirm, you must…

- Be a resident of the US or a US territory

- Be at least 18 years old (or 19 if you are a ward of the state in Nebraska)

- Have a valid Social Security Number

- Have a phone that can receive SMS text messages and is set up and registered for cellular service in the US or US territories

While these are the basic requirements, there are also a few other factors that will impact whether or not you qualify for Affirm.

Your Affirm application may be impacted by any or all of the following…

- Your credit and credit utilization score

- Any recent bankruptcies

- Your income

- Your debt obligations (if any)

Finally, when submitting requests for financing through your Affirm account, your requests may be approved or denied based on any of the following…

- Your existing payment history with Affirm (if any), including overdue or deferred payments or loan delinquency

- How long you have had an Affirm account (if applicable)

- How many loans you currently have with Affirm (if applicable)

Generally speaking, Affirm will not offer financing over $17,500 total to any one customer.

Eligible and Ineligible Items

Most general merchandise sold through Walmart or Walmart.com can be purchased with Affirm if it meets a few criteria. However, not everything at Walmart can be financed with Affirm.

Affirm financing is available on eligible Walmart purchases between $150–$2000 after tax.

Eligible categories include…

- Electronics (including laptops, TVs, iPhones, video games, and more)

- Home goods (such as mattresses, furniture, and more)

- Home improvement items

- Auto parts and tires

- Kitchen and dining

- Floor care

- Arts and crafts

- Musical instruments

- Sports and outdoor gear

- Toys

- Baby items

- Apparel

- Jewelry

Items and services that cannot be paid for with Affirm at Walmart include…

- Groceries

- Gasoline

- Alcohol and tobacco

- Baby food

- “Impulse” items (merchandise housed next to the registers such as magazines, gum, etc.)

- Pet food and supplies

- Weapons (including firearms, ammunition, gun accessories, air guns, and hunting supplies)

- Pharmacy or health and wellness items (including personal care items)

- Money services

- Wireless service plans

- One-hour photo services

To learn more about what you can and can’t do with Affirm at Walmart, click here.

Payment Schedules, Interest Rates, & Fees

An Affirm loan is typically paid back according to a 3-, 6-, or 12-month term. However, smaller loans can sometimes be financed over one to three months while bigger loans can sometimes qualify for two-year terms. A longer term means lower monthly payments, but you will end up paying more in interest in the long run. Affirm’s interest rates range from 0% to 36% depending on the terms of your loan (it’s worth noting that 36% interest is astronomically high).

That said, Affirm lets you know what your interest will be upfront in real dollars, rather than making you decipher a cryptic interest rate. Before moving forward with your financing, you will be given the opportunity to accept or reject the terms of your interest, knowing exactly how much you will pay over time.

Affirm’s most straightforward loan plan divides the amount of your total purchase into four equal installments with zero interest. The first installment is typically due at checkout, and the three remaining installments are automatically billed to you every two weeks until the loan is paid off (making it a six-week term). Details regarding your loans and payments can all be viewed in the Affirm app.

The best part of using Affirm (aside from flexible financing) is the fact that you will avoid the fees often associated with utilizing credit. Affirm proudly advertises the fact that they charge zero fees–no late fees, no annual fees, and no fees to open or close your account.

It’s important to be aware, though, that even though Affirm doesn’t charge late fees, you could pay for it in other ways if you lapse on your payment schedule. Missing payments can hurt your ability to receive Affirm loans in the future, and it can also damage your credit score overall.

How To Use An Affirm Virtual Card at Walmart

Anytime you shop with Affirm at Walmart, you will need to apply for a temporary virtual credit card.

These virtual cards function like one-time use credit cards and are approved conditionally based on the amount you’re spending.

Be aware that you may not always qualify for the full amount of your purchase, even if you are approved for a loan.

Using Affirm At Self Checkout

To use Affirm at a self checkout register at Walmart, follow these steps…

- Using your phone, apply for a loan by opening the Affirm app or visiting www.affirm.com/walmart (click “Apply Now”)

- Enter the amount you’re spending and choose a payment plan

- Scan the single-use barcode using the self checkout machine

- Your payment will then be complete and you will need to make your payments online with Affirm according to the payment schedule you chose

For more help, check out this YouTube video from MrOctopus about how to use Affirm at Walmart.

You can also get prequalified before you go shopping if you know what you’re planning on buying and spending.

Using Affirm Online At Walmart.com

When paying with Affirm on Walmart.com, you will need to use something called a virtual card. A virtual Affirm card works just like a standard credit card, but it uses temporary card information.

To pay with Affirm on Walmart.com, follow these steps…

- Place your desired items into your cart (make sure they are Affirm eligible and that your order total reaches at least $150)

- When you know your total, log into your Affirm account through your web browser or the Affirm app on your smartphone and apply for financing

- If approved, you will be provided with virtual card info (keep the tab or app open)

- Back on Walmart.com, choose “credit card” as your payment method, then enter the card number and other info you received from Affirm

Your purchase will now be complete and you will need to make your payments through Affirm (you will receive payment reminders).

For more information about how to use Affirm at Walmart, click here.

Customer Reviews of Affirm

When it comes to Affirm, customers are very divided.

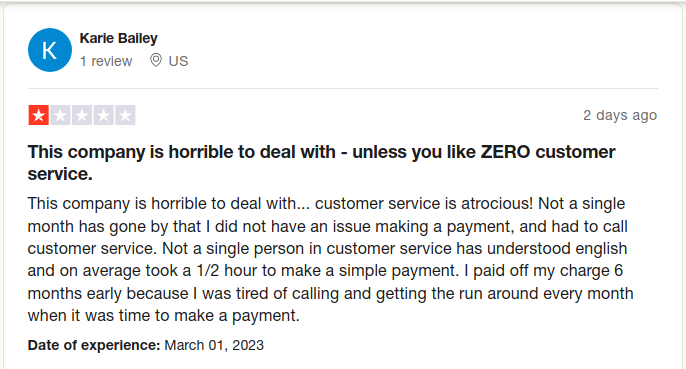

While most feedback has been positive, there are some truly scathing reviews that deal with insufficient customer service and issues regarding payments and refunds. These are serious problems, and there are too many of them to write off as simple misunderstandings or isolated problems.

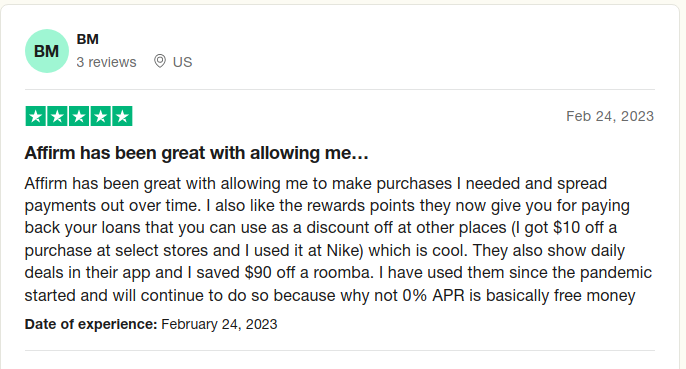

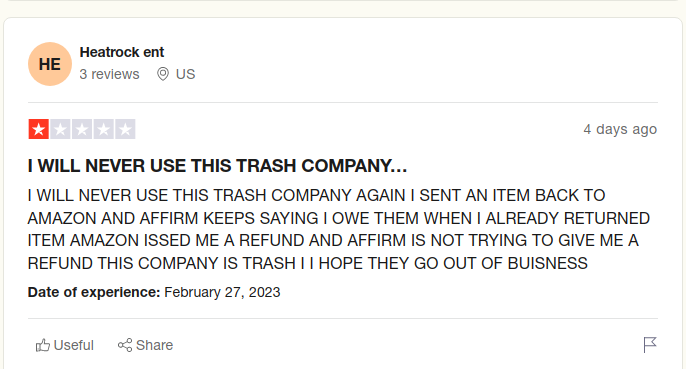

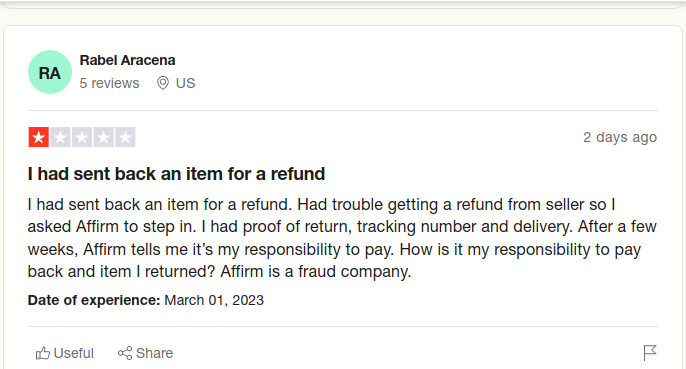

First, we’ll look at some positive reviews from users on TrustPilot.com…

But now, the negative reviews…

As you can see, using Affirm could be a risk. While it can offer a great financial service to customers who don’t need much assistance, it’s clear that they’re lagging behind when it comes to customer service.

Benefits of Using Affirm at Walmart

While there are some noteworthy critiques of Affirm’s service, the company still offers some notable benefits to customers.

In closing, some of the benefits to shopping with Affirm include…

- It’s a flexible alternative to applying for a traditional credit card, requiring no hard credit check or minimum credit score, making it accessible for a wide range of shoppers

- You can shop with Affirm at any Walmart store, Walmart.com, or through the Walmart app

- You can choose from several different payment plan options, ranging from six weeks to two years

- Shopping with Affirm allows you to make major purchases when you need to even if you can’t afford to pay in full up front

- You can make your payment easily from your smartphone through the Affirm app

FAQs

Is it hard to get approved for Affirm through Walmart?

No. Affirm is generally considered an accessible service that most people can qualify for as long as they have decent credit. If your credit score is below 550, however, you might not get approved.

Does Affirm give you a physical card?

In some cases. Affirm primarily offers “virtual cards” that connect to and work in tandem with the affirm App. However, they also recently introduced a physical card called the Affirm Debit+, but not all customers are eligible. This card is currently available on an invite-only basis.

Can you use the Affirm virtual card more than once?

No. Affirm virtual cards are designed for one-time use. Each time you need a loan through Affirm, you will need to apply for a new virtual card.

Can you pay off your Walmart Affirm loan early?

Yes. You can pay off your loan early without facing any penalties or fees. In fact, paying off your credit loans early is a great way to maintain good standing with Affirm.

Can you return Walmart purchases made with Affirm?

Yes. Returns can be processed through Walmart’s standard returns process and the amount of your purchase will be credited back to your Affirm account. To learn more about Walmart’s return policy, check out our post about it here.

Can you turn your Affirm virtual card into cash?

No. Affirm virtual cards function like one-time use credit cards and cannot be exchanged for cash. However, if you use Affirm for your other banking services, you can withdraw money from your Affirm checking or savings account. Learn how here.