Green Dot Bank is an online banking service providing mobile banking and credit solutions to 67 million customers worldwide. In recent years, Green Dot has partnered with Walmart to provide exclusive debit cards and banking options to Walmart customers.

Unfortunately, the Green Dot info page on Walmart.com isn’t all that helpful for understanding how these Green Dot Walmart cards actually work. So, we’re here to clear up the confusion and explain exactly what a Green Dot card is, how to get one, and whether it’s right for you.

Contents

Green Dot Visa Debit vs. Walmart MoneyCard

First of all, there are two different types of Green Dot cards available through Walmart–the Walmart MoneyCard and the prepaid Green Dot Visa debit card.

The Walmart MoneyCard is a reloadable Mastercard debit card that comes with several perks for Walmart customers that the standard Green Dot Visa debit card does not offer.

Walmart MoneyCard

The Walmart MoneyCard is a debit card issued by Green Dot Bank that allows Walmart shoppers to earn 3% cash back on all Walmart.com purchases, 2% on Walmart fuel, and 1% for Walmart in-store purchases.

Unfortunately, these cashback benefits are limited to $75 per year. Unlike with other rewards cards, your cashback rewards are credited to your account in one lump sum at the end of the year rather than being distributed each billing period.

Other benefits of using the Walmart MoneyCard include…

- Overdraft protection up to $200 (opt-in required)

- Early direct deposit (get your paychecks or government benefits up to 2 days early – limitations apply)

- 2% interest earned on savings

- Monthly opportunities to win cash prizes

A Walmart MoneyCard can be used to make purchases anywhere Mastercard is accepted.

Keep reading to find out how to sign up for a Walmart MoneyCard.

Green Dot Prepaid Visa Debit Card

Unlike a Walmart MoneyCard, the Green Dot Visa Debit Card does not offer any special perks for Walmart customers. However, you can purchase one of these cards on Walmart.com or at a Walmart store location for $1.95.

Once you’ve purchased your card, you can register for your Green Dot Bank account online and begin loading money onto your card.

A Green Dot Visa Debit works just like a normal debit card and can be used anywhere Visa cards are accepted. However, unlike standard debit cards, the Green Dot Visa must be preloaded with a set amount of money. Once the card is empty, it can be reloaded with cash at any Walmart location or by using your online Green Dot account.

This simple prepaid Visa card comes with zero overdraft fees (because it’s not possible to overdraw a preloaded card). It also allows you to sign up for early direct deposit, just like the Walmart MoneyCard.

Benefits of Using The Walmart MoneyCard

If you’re a frequent Walmart shopper, then you’ll probably want to look into getting a Walmart MoneyCard instead of a Green Dot Visa Debit, as it offers higher rewards.

Walmart.com lists the following benefits of using a Walmart MoneyCard…

How To Get A Walmart Green Dot Card

You can purchase a prepaid Green Dot Visa debit card on Walmart.com for just $1.95. Once you receive your card, you can register for a Green Dot Bank account, activate your card, and begin adding money to your account.

When you open a Walmart MoneyCard account, you will be asked to provide your name, physical address, phone number, email address, social security number, and date of birth. You will also be asked to consent to a verification of your tax information.

You can sign up for a Walmart MoneyCard online here or by visiting any Walmart location in person. Simply visit a cashier at any register or find the Walmart Money Center and let an employee know you would like to sign up for a Walmart MoneyCard.

You must be at least 18 years old to sign up.

Registration & Activation Steps

To register or activate your Green Dot card, click here and enter your card information into the digital form provided. You can also activate by calling (866) 946-2510.

Walmart MoneyCards cannot be used prior to activation. In most cases, you will open your Walmart MoneyCard account online prior to receiving your physical card in the mail. However, your card will still need to be activated by ensuring money has been deposited into your account.

To log in to your Green Dot account for any reason, click here.

Using Your Walmart Green Dot Card

Below, we’ll go over some of the things you can do with your Walmart MoneyCard or Green Dot Card.

If you ever need help with your Green Dot card, you can contact their customer service by clicking here. You can also log into your Green Dot account online or through the app to access Green Dot’s chat help feature.

Checking Your Balance & Transactions

The quickest way to check your Green Dot card balance is to log in to your Green Dot or Walmart MoneyCard account. Follow this link and click “log in” in the top right corner of the page.

If you add a mobile number to your account information, you can also check your balance and recent transactions via text message, according to GreenDot.com…

Deposits

Adding money to your Walmart MoneyCard is super easy. You can receive deposits directly into your account from employers and government agencies, deposit cash directly at Walmart, or even deposit checks on the go with your smartphone.

You can also link another bank account to your Walmart MoneyCard account to easily transfer money between accounts.

To learn more about depositing cash into your Walmart MoneyCard account, check out this video.

Loading Your Card

The easiest way to load your Green Dot card is to visit any Walmart store location and find the Walmart Money Center. From there, you can use cash or another card to load money onto your Green Dot card.

You can also load your card by logging into your Walmart MoneyCard account online and…

- Transferring money from another account

- Receiving a direct deposit

- Depositing a check

Withdrawing Cash

Withdrawing cash from your Walmart MoneyCard is simple–you can use an ATM to withdraw cash the way you would with any other debit card. You can also visit the Walmart Money Center counter to withdraw cash, which is necessary if you need to withdraw more than $300 at a time.

The following limits apply to withdrawing cash from your account…

- Per ATM withdrawal transaction: $300

- Per day: $500

- In-bank withdrawal limit (with teller): $1,500

The Walmart Money Center also enables customers to withdraw up to $1,500 from their account at a time.

If you have a prepaid Green Dot Visa Debit Card, you will not be able to withdraw cash from this card as it is not linked to a bank account.

Canceling Your Card

If you would like to cancel your Green Dot card, the process for doing this will depend on what kind of card you have.

A prepaid Visa debit card cannot be canceled. Instead, you can simply use up the balance on the card and then safely dispose of the card. If you would like to close your Green Dot account altogether, click here.

If you need to cancel your Walmart MoneyCard, the process is a bit more detailed.

Walmart.com provides the following instruction for canceling your Walmart MoneyCard account…

If you are considering canceling your card because it’s been lost or stolen, you do not have to close your account to protect yourself.

Simply call customer service at 1-800-903-4698 as soon as you realize your card is missing. Follow the prompts to “report a lost or stolen card.” You will not need to provide your card number to report your card as lost or stolen. Once the report has been filed, Green Dot will issue you a replacement card.

Linking Green Dot To CashApp

Some Green Dot Bank cards can be linked directly to your Cash App account. However, the only Green Dot card that allows for this is the Green Dot Cash Back Visa Debit Card, which is not available at Walmart.

Luckily, you can still register your Green Dot Bank account with your Cash App account so that you can transfer money from your Cash App balance into your Green Dot account.

Check out this article from Top Mobile Banks to learn more about linking Green Dot and Cash App. By linking a Green Dot Cash Back Debit Card to your Cash App account, you can send money easily from your bank account to your friends and family without having to initiate a bank transfer or costly wire transfer.

Get Your Tax Return Early

Along with allowing direct deposit, the Walmart MoneyCard also allows you to receive your tax refund directly into your Green Dot Bank account. You can even get your tax return a few days early in some cases.

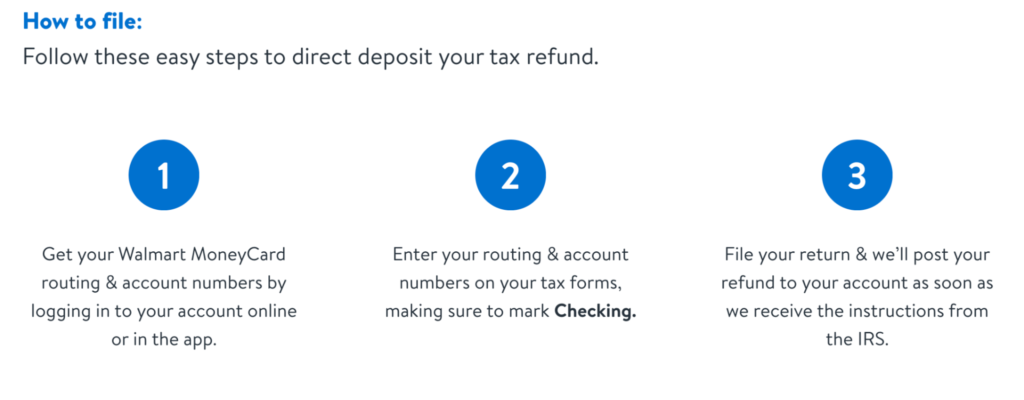

Here are some helpful steps from Walmart.com explaining how to set up direct deposit for your tax return…

The bank routing number associated with your Walmart MoneyCard account is 124303120.

Drawbacks of the Walmart MoneyCard

When it comes to the Walmart MoneyCard, there are some important drawbacks to be aware of…

- You will be charged a monthly fee of $5.94 unless you deposit at least $500 into your account each month

- You can open linked accounts with family members, but it will cost you $5.94 per account per month unless you deposit at least $500 into each account every month

- You can only earn cashback rewards when shopping at Walmart

- Cash back rewards are limited to $75 per year, which is very low for a cash back rewards card

That said, it’s not typical for debit cards to offer cash back rewards, so the Walmart MoneyCard could still seem worth it to those who want a few perks but can’t qualify for a credit card. The Walmart MoneyCard presents a decent solution for those who want a simple and convenient banking alternative without the need for a good credit score.

The Walmart MoneyCard does not require an application or credit check, and you will never be charged interest or an annual fee.